9 Easy Facts About Hard Money Atlanta Explained

Wiki Article

Rumored Buzz on Hard Money Atlanta

Table of ContentsThe Ultimate Guide To Hard Money AtlantaOur Hard Money Atlanta DiariesThe Single Strategy To Use For Hard Money AtlantaOur Hard Money Atlanta IdeasHard Money Atlanta Fundamentals Explained

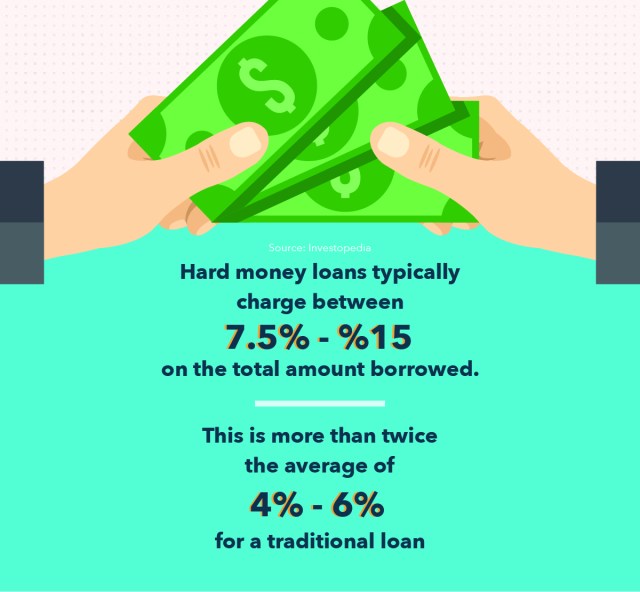

In the majority of areas, rates of interest on difficult money fundings run from 10% to 15%. In addition, a consumer may need to pay 3 to 5 factors, based upon the overall lending amount, plus any type of appropriate appraisal, evaluation, and also management charges. Numerous tough cash lenders require interest-only payments during the brief period of the funding. hard money atlanta.Difficult cash lenders make their cash from the passion, factors, as well as charges billed to the borrower. These lending institutions aim to make a quick turn-around on their financial investment, therefore the higher rate of interest as well as much shorter regards to difficult money finances. A hard cash funding is an excellent suggestion if a debtor requires money rapidly to buy a home that can be rehabbed as well as flipped, or rehabbed, rented and also re-financed in a relatively brief amount of time.

The Greatest Guide To Hard Money Atlanta

For exclusive investors, the most effective component of obtaining a difficult cash loan is that it is less complex than obtaining a conventional home loan from a bank. The approval procedure is normally a lot less intense. Financial institutions can request a virtually unlimited series of papers as well as take numerous weeks to months to get a finance authorized.The major purpose is to make certain the customer has a departure method as well as isn't in financial wreck. However several difficult cash lending institutions will certainly deal with people that do not have wonderful debt, as this isn't their greatest concern. One of the most essential thing hard money lenders will certainly look at is the financial investment residential property itself.

Hard Money Atlanta Things To Know Before You Buy

There is an additional benefit constructed right into this procedure: You obtain a second set of eyes on your deal as well as one that is materially spent in the task's end result at that! If a deal misbehaves, you can be relatively positive that a tough cash lending institution will not touch it. Nevertheless, you must never ever use that as a reason to discard your very own due persistance.The best place to seek hard cash lending institutions remains in the Bigger, Pockets Tough Cash Loan Provider Directory or your neighborhood Property Investors Association. Remember, if they have actually done right by one more investor, they are most likely to do right by you.

Read on as we go over hard money loans as well as why they are such an eye-catching choice for fix-and-flip actual estate investors. One significant benefit of difficult cash for a fix-and-flip investor is leveraging a relied on lender's reputable resources and speed.

What Does Hard Money Atlanta Do?

You can take on projects incrementally with these strategic lendings that enable you to rehab with simply 10 - 30% down (depending upon the loan provider). Tough cash loans are generally short-term fundings utilized by investor to fund repair as well as flip buildings or various other genuine estate financial investment offers. The property itself is used as security for the lending, and also the high quality of the realty offer is, for that read reason, more vital than the borrower's credit reliability when receiving the funding.This additionally indicates that the risk is greater on these fundings, so the interest prices are normally higher also. Repair and turn investors pick difficult cash since the market does not wait. When the opportunity occurs, and you're all set to obtain your project right into the rehab stage, a hard cash lending obtains you the cash straightaway, pending a reasonable assessment of business offer.

Eventually, your terms will depend on the difficult cash lender you select to function with and your special circumstances. Right here's a checklist of typical demands or qualifications. Geographic place. useful link The majority of hard money lending institutions run locally or in particular areas. However, numerous run across the country, Kiavi currently provides in 32 states + DC (and also counting!).

8 Easy Facts About Hard Money Atlanta Explained

Intent and residential property documents includes your in-depth range of work (SOW) and insurance (hard money atlanta). To analyze the building, your lending institution will certainly take a look at the value of equivalent residential or commercial properties in the area and also their forecasts for growth. Adhering to a price quote of the residential property's ARV, they will money an agreed-upon portion of that value.This is where your Extent of Work (SOW) comes into play. Your SOW is a record that details the work you mean to carry out at the property and also is normally required by the majority of difficult money loan providers. It includes improvement expenses, responsibilities of the celebrations involved, as well as, frequently, a timeline of the deliverables.

Allow's assume that your building doesn't have actually a finished basement, yet you are planning to finish it per your extent of work. Your ARV will be based upon the sold prices of equivalent homes with completed cellars. Those prices check my blog are likely to be greater than those of residences without finished cellars, hence increasing your ARV as well as possibly qualifying you for a higher financing amount. hard money atlanta.

Report this wiki page